Have you ever wished you could own a portion of upscale office parks, corporate buildings, or workspaces?

Yes, you can, and it doesn’t cost crores.

Like stocks, you can invest in these types of projects through Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

Consider REITs and InvITs as a more straightforward approach to infrastructure or real estate investment. They function similarly to mutual funds, combining the capital of several investors to make investments in infrastructure or real estate.

When investing in REITs or InvITs, there are two primary ways to profit. One is through “distributions,” which are recurring payments. The other is by the REIT or InvIT’s unit price increasing.

However, how can you pick the best REIT or InvIT for your portfolio when there are so many listed on the exchange? We’ll go over important criteria in this post to assist you in assessing REITs and InvITs.

First, let’s clarify what InvITs and REITs are.

REITs: What are they?

Similar to a mutual fund, a Real Estate Investment Trust (REIT) makes investments in real estate rather than equities. Similar to purchasing shares, you can invest in a REIT.

REITs combine investor funds to purchase commercial real estate, including malls, offices, and special economic zones. REITs are mandated by law to invest at least 80% of their capital in finished projects that generate income.

Investors receive quarterly payouts, or “distributions,” from the rental income from these properties. A REIT’s unit price may increase in tandem with its business performance, much like the price of a stock.

As an investor in REITs, you can profit from both price growth and those recurring payouts. At the moment, REITs must distribute a minimum of 90% of their net distributable cash flow (NDCF), which is the cash flow left over after paying for reserves, debt service, and financing charges.

There are four REITs available in India:

- Embassy Office Parks: Nexus Select Trust

- Business Parks Mindspace

- REIT Brookfield India

InvITs: What Are They?

Infrastructure Investment Trusts, or InvITs, are similar to mutual funds but specifically for infrastructure. They allow you to own a portion of large projects, such as power plants, bridges, highways, and roads, and are exchange-traded. InvITs, which are professionally managed and subject to SEBI regulation, provide income in the form of dividends, interest, and possible capital gains without the burden of project management.

Like REITs, InvITs are subject to regulations, which require them to allocate 90% of their NDCF and invest at least 80% of their capital in finished, revenue-generating projects. This implies that, based on the InvIT’s performance, you can benefit from both monthly payouts and any increase in the unit price.

Four InvITs are now listed publicly on Indian stock exchanges:

- Bharat Highways InvIT, India Grid Trust,

- IndiGrid Powergrid Infrastructure Investment Trust,

- or PG InvIT IRB InvIT Fund

The newest of these is Bharat Highways InvIT, which was only listed in March 2024. A few private InvITs are also listed on the exchanges in addition to these InvITs.Let’s now examine how to analyze various REITs and InvITs.

Criteria for Assessing InvITs and REITs

We have separated the examination of InvITs and REITs into four main sections in order to assess them:

Financial Distributions and Assessments of the Portfolio

Their quarterly, half-yearly, and annual reports contain the majority of the information that is required.

Six REITs and InvITs are the subject of our examination below. It should be noted that Bharat Highways InvIT and Nexus Trust REIT have little historical data because they are very new.

1. Analysis of the Portfolio:

The assets that a REIT or InvIT invests in are represented by the portfolio.

Embassy Office Parks, for instance Nine office parks, four city center office buildings in the NCR, Bengaluru, Pune, and Mumbai, four business hotels that are currently open, two hotels that are being built, and a solar park are all owned by REIT.

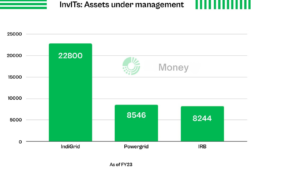

In contrast, IndiGrid InvIT has transmission lines spanning more than 8,468 circuit kilometers and 35 power projects spread over 20 states and one union territory.

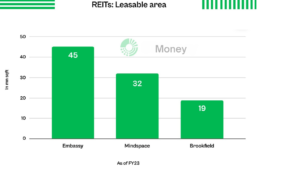

The leasable area of several REITs is contrasted in this graphic.

Therefore, look at how a REIT or InvIT’s assets are distributed among various properties and geographical areas while assessing it. Generally speaking, a more concentrated portfolio carries greater risk.

Selecting between various REITs or InvITs can be aided by portfolio comparison. Additionally, knowing how the portfolio aligns with the state of the economy can help you forecast its chances going forward.

In general, spend some time reading the annual report and getting to know the REIT or InvIT you are investigating and its portfolio.

2. Examining finances:

Evaluating REITs and InvITs from a financial standpoint is comparable to evaluating any business. Examine cash flows, debt, profitability, and revenues. Historical trends can provide insights, and annual reports’ financial statements are an excellent place to start.

For example, the sales and earnings of various REITs are displayed in the table below.

REITs: Net income and revenues (in Rs cr) |

|||

| Fiscal year | Embassy | Mindspace | Brookfield |

| Revenues | |||

| FY23 | 3,564 | 2,304 | 1,229 |

| FY22 | 3,090 | 1,770 | 899 |

| FY21 | 2,479 | 1,157 | 136 |

| FY20 | 2,244 | NA | NA |

| Net profits | |||

| FY23 | 506 | 309 | 131 |

| FY22 | 888 | 447 | 246 |

| FY21 | 698 | 335 | 25 |

| FY20 | 766 | NA | NA |

While revenues grew, profits for all 3 REITs declined in FY23, likely due to higher interest rates and rising costs.

Let’s look at the revenues and net profits of different InvITs.

BrookfiInvITs: revenue and net income (in Rs crores) |

|||

| Fiscal year | IndiGrid | Powergrid | IRB |

| Revenues | |||

| FY23 | 2,414 | 1,315 | 1,462 |

| FY22 | 2,274 | 1,243 | 1,400 |

| FY21 | 1,714 | NA | 1,161 |

| FY20 | 1,279 | NA | 1,270 |

| Net profits | |||

| FY23 | 466 | -446 | 370 |

| FY22 | 343 | 463 | 303 |

| FY21 | 334 | NA | 181 |

| FY20 | 506 | NA | 173 |

Power grid InvIT recorded a net loss in FY23 as a result of a non-cash goodwill write-off.

Aside from typical measurements, REITs and InvITs offer unique indications like:

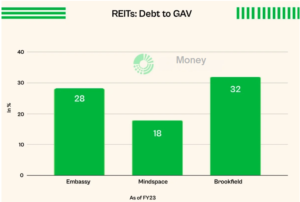

Debt to GAV: This indicator compares debt to gross asset value (GAV). It compares a REIT’s debt to its total asset value (GAV). Simply explained, GAV is the total worth of all the assets that a REIT holds.

The graphic below depicts Embassy, Mindspace, and Brookfield REITs’ debt-to-GAV ratios. A smaller ratio typically indicates stronger solvency.

AS OF FY23

Debt to AUM: A related indicator for InvITs is ‘debt to AUM.’ Because infrastructure investments sometimes include financing, a somewhat higher debt-to-AUM ratio is not always a bad sign.

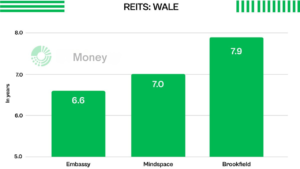

WALE: Another important indicator for REITs is WALE, or Weighted Average Lease Expiration. WALE displays the average amount of time remaining on leases for a REIT’s properties, assisting in assessing the risk of vacancies.

AS OF FY23

This allows you to estimate the financials of REITs and InvITs.

Distributions are the coming subject of analysis.

3. Distribution Analysis.

- Distributions are a primary explanation for investing in REITs and InvITs. They’re similar to tips, but not identical.

- For illustration, Brookfield REIT’s distribution payout in Q3FY24 included interest on shareholder loans, loan disbursements, and FD interest; there was no” tip” element.

- IRB InvIT’s third- quarter FY24 distribution includes both interest and tips.

For REITs and InvITs, it’s preferable to use the term” distribution” rather than” tip”. Flash back that these distributions are tested else. It’s critical that the REIT or InvIT has constant and growing payouts.Let’s take a look at the distributions for Embassy, Mindspace, and Brookfield REITs.

REITs’ Distributions per Unit (Rs) |

|||

| Fiscal year | Embassy | Mindspace | Brookfield |

| FY23 | 10.1 | 19.1 | 20.2 |

| FY22 | 9.9 | 18.5 | 22.1 |

| FY21 | 3.0 | 9.6 | NA |

| FY20 | 0.4 | NA | NA |

While Embassy and Mindspace have raised dividends, Brookfield has kept them stable over the last two fiscal years.

Let’s look into IndiGrid, Powergrid, and IRB InvITs as well.

REITs: Distributions per Unit (in Rs) |

|||

| Fiscal year | Embassy | Mindspace | Brookfield |

| FY23 | 10.1 | 19.1 | 20.2 |

| FY22 | 9.9 | 18.5 | 22.1 |

| FY21 | 3.0 | 9.6 | NA |

| FY20 | 0.4 | NA | NA |

IndiGrid and Powergrid have performed better for InvITs, whereas IRB rewards have decreased.

When comparing distributions to unit prices, consider the distribution yield, which is an important valuation metric.

4. Value Analysis:

Valuation measures assist assess whether a REIT or InvIT is appropriately priced:

Price-to-NAV Ratio: This ratio indicates whether the unit price is at a premium or discount to its net asset value. For example, as of September 2023, Embassy REIT’s NAV per unit was Rs 399, while its market price was Rs 382, representing a 4% discount. A comparable check with IndiGrid InvIT revealed a 1.5% discount.

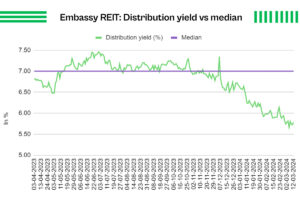

Distribution Yield: Higher yields are normally preferred. For example, the figure below displays Embassy REIT’s one-year payout yields.

As of March 12, 2024, the yield was below the one-year median, indicating that it may be expensive.

These metrics can be used to determine valuation. Ideally, seek for REITs or InvITs that are trading at a discount to their NAV and have a distribution yield that is higher than the median.

Differences Comparing REITs and InvITs

REITs invest in income-generating real estate properties, whereas InvITs fund infrastructure projects such as highways and power plants, which generate money through usage fees or tolls.

The following table summarizes the key differences between REITs and InvITs:

Criteria |

REIT (Real Estate Investment Trusts) |

InvITs (Infrastructure Investment Trusts) |

| Asset Type | Invest in real estate assets such as office buildings, hotels, and shopping malls. | Invest in infrastructure projects such as roads, power plants, and transmission lines. |

| Revenue Sources | Earn money by leasing homes and collecting rent. | Make money by operating infrastructure assets, often through tolls or usage fees. |

| Investment Focus | Concentrate on income-producing real estate properties. | Concentrate on infrastructure projects with predictable financial flows. |

The importance of REITs and InvITs

REITs and InvITs play an important part in investment plans because they provide distinct advantages.

- Allows you to obtain exposure to real estate and infrastructure without actually owning the property.

- Provide consistent revenue through regular distributions, akin to dividends, which can provide dependable cash flow.

- These investments assist to diversify your portfolio beyond standard equities and bonds, which reduces total risk.

- If you wish to invest in mutual funds, use the ET Money app. You can track all of your assets in one spot in addition to receiving

- commission-free investing. In addition, you get free access to tools such as a portfolio health check, which helps you detect hidden hazards in your portfolio.

FAQs:

Which is better: REITs or InvITs?

It depends on your investment objectives. REITs concentrate on real estate, whereas InvITs invest in infrastructure. The article above contains a full comparison.

How many REITs and InvITs exist in India?

Currently, India has four REITs and around 19 InvITs listed; however, the number of REITs and InvITs is increasing.

What are the minimum and maximum investment limits for REITs and INVITs?

Investment restrictions may vary. You can start with as low as Rs 400 and there is no maximum limit.

What are the advantages and disadvantages of REITs and InvITs?

REITs and InvITs offer both benefits and drawbacks. While they provide consistent income and diversification, they also introduce market risks and regulatory changes. The advantages and disadvantages of REITs and InvITs are explored in depth above.

What are the different forms of REITs and InvITs?

REITs invest in real estate assets such as offices and malls. InvITs specialize on infrastructure projects such as highways, power plants, and warehouses.

What are some cases of REITs and INVITs?

exemplifications include Embassy Office Parks REIT, Mindspace Business Parks REIT, IRB InvIT Fund, and India Grid Trust for InvITs.