Best Health Insurance in India 2025 – Top Plans & Complete Comparison

Best Health Insurance in India 2025 is no longer optional—it’s a necessity. With rising medical inflation, even a short hospital stay can cost anywhere from ₹50,000 to ₹5 lakh. Without the right insurance plan, families risk draining their savings during emergencies.

In this guide, we will compare the top health insurance policies in India for 2025 based on coverage, claim settlement ratio, benefits, and affordability.

Why Do You Need the Best Health Insurance in 2025?

Medical Inflation: Healthcare costs in India are increasing at 12–15% per year.

Emergency Protection: Unexpected surgeries and treatments can financially burden families.

Tax Benefits: Premiums are eligible for deductions under Section 80D of the Income Tax Act.

Peace of Mind: The right health policy ensures quality healthcare without financial stress.

Factors to Consider Before Choosing the Best Health Insurance in India 2025

Coverage Amount – A minimum coverage of ₹5–10 lakh is recommended for individuals, and higher for families.

Cashless Network Hospitals – Always ensure your preferred hospitals are in the insurer’s network.

Premium vs Benefits – Don’t only go for the cheapest plan, balance affordability and features.

Claim Settlement Ratio (CSR) – A higher CSR means a smoother claim experience.

Add-ons – Maternity cover, critical illness protection, personal accident rider, etc.

Best Health Insurance Plans in India 2025 – Full Comparison

| Insurance Company | Plan Name | Coverage (₹) | Claim Settlement Ratio | Key Benefits |

|---|---|---|---|---|

| HDFC ERGO | Optima Restore | 5 – 50 lakh | 96% | Automatic sum insured restore |

| ICICI Lombard | Complete Health | 3 – 25 lakh | 95% | No room rent restrictions |

| Star Health | Family Health Optima | 5 – 25 lakh | 93% | Affordable family floater plan |

| Niva Bupa | Health Companion | 5 lakh – 1 crore | 94% | Free annual health check-ups |

| Care Health | Care Plus | 5 – 75 lakh | 95% | High coverage with multiple add-ons |

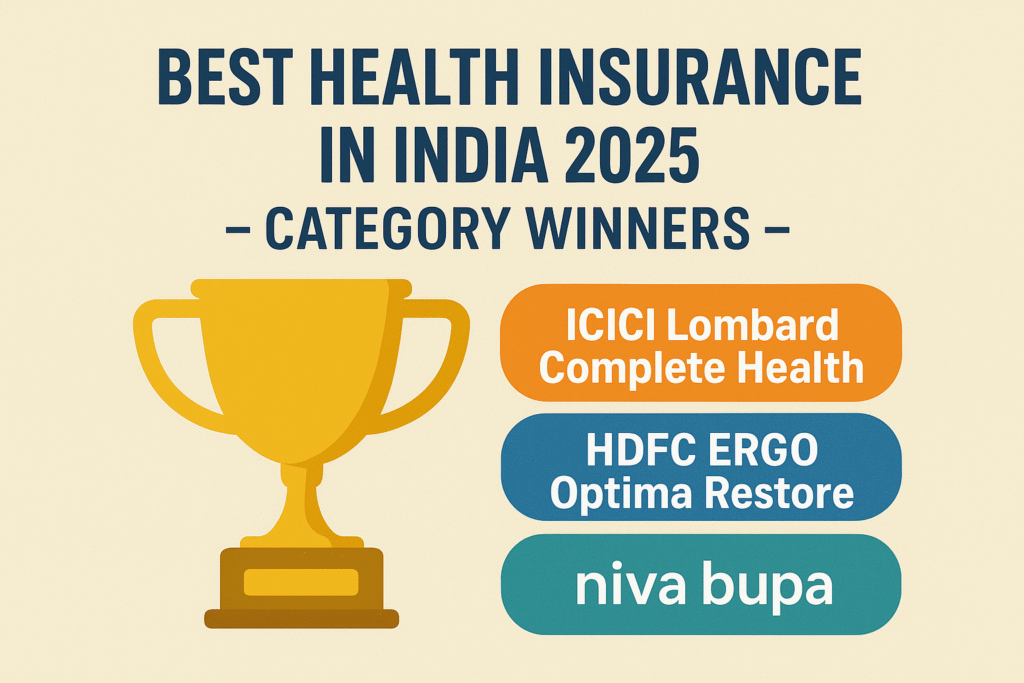

Best Health Insurance in India 2025 – Category Winners

Best for Families → Star Health Family Health Optima – Affordable premium and wide hospital network.

Best for Young Professionals → ICICI Lombard Complete Health – No room rent limits, ideal for metro treatments.

Best High Coverage Plan → Max Bupa Health Companion – Coverage up to ₹1 crore with added benefits.

Best Overall (2025 Winner) → HDFC ERGO Optima Restore – High coverage, excellent claim ratio, and useful features.

Real-Life Example of Choosing the Best Health Insurance in India 2025

Let’s take an example. Rajesh, a 32-year-old IT professional living in Bangalore, wanted health insurance for himself, his wife, and one child. He compared different family floater plans and initially thought of taking the cheapest one. However, after checking claim settlement ratios and hospital networks, he realized that slightly higher premiums offered much better coverage. Finally, he chose HDFC ERGO Optima Restore because it provided ₹25 lakh coverage, cashless treatment in top Bangalore hospitals, and lifetime renewability. This decision gave him financial security and also helped him save taxes under Section 80D.

How to Apply for the Best Health Insurance in India 2025

Visit the insurer’s official website.

Enter personal details like age, city, and family members.

Compare different premium options.

Upload KYC documents.

Pay online and download your policy instantly.

Tips for Choosing the Right Health Insurance Policy

Don’t just buy the cheapest plan—always check benefits carefully.

Choose lifetime renewability to avoid problems later.

Use top-up plans to increase coverage affordably.

Review and update your policy every 2–3 years.

Common Mistakes People Make While Buying Health Insurance

Choosing Low Coverage Just to Save Money – Even one surgery can cost ₹10 lakh. Always go for at least ₹10–25 lakh coverage.

Not Checking Hospital Network – Always confirm hospital tie-ups before purchase.

Ignoring Critical Illness Add-ons – Expensive treatments like cancer or heart surgery can drain savings.

Not Reading Policy Terms – Be aware of exclusions and waiting periods.

FAQs on Best Health Insurance in India 2025

Q1. What is the minimum coverage I should take in 2025?

👉 At least ₹5–10 lakh for individuals, and ₹25 lakh or more for families in metro cities.

Q2. Which plan is best for senior citizens in India 2025?

👉 HDFC ERGO Optima Restore and Star Health Senior Citizen plan are popular choices.

Q3. Can I save tax with health insurance?

👉 Yes, under Section 80D, you can claim up to ₹25,000 (₹50,000 for senior citizens) as tax benefits.

Q4. Which is better: Individual or Family Floater Policy?

👉 Family Floater is usually more affordable if you want coverage for multiple family members under a single premium.

Q5. Can NRIs buy health insurance in India 2025?

👉 Yes, many insurers allow NRIs to purchase health insurance in India.

Conclusion

Health insurance is no longer optional – it’s a necessity in today’s world of rising medical costs. Choosing the best health insurance in India 2025 is not only about finding the lowest premium but also about ensuring the right coverage, claim settlement ratio, and hospital network.

When you compare the best health insurance in India 2025, look at features such as automatic sum insured restore, no room rent limits, critical illness riders, and cashless hospital tie-ups. These small details can make a big difference when an emergency arises.

The best health insurance in India 2025 plans like HDFC ERGO Optima Restore, ICICI Lombard Complete Health, Star Health Family Health Optima, and Max Bupa Health Companion are excellent choices depending on your budget and needs. Whether you are a young professional, a growing family, or someone looking for high coverage, there is a plan that fits perfectly.

By securing the best health insurance in India 2025, you are not just buying a policy – you are protecting your family’s financial future, ensuring peace of mind, and gaining long-term security. Make your choice wisely today, and safeguard tomorrow.